Why are revocable living trusts used?

A revocable trust allows you to avoid probate. This saves both the three to nine month wait for completion of the probate process and the following cash savings:

- Probate fees of $200 per every $100,000 of property you own.

- Attorney fees of approximately $1500 to $4000 for handling an uncontested probate.

- Double the above costs in the event that you have property in more than one state. Approximately an additional $1500 to $5000

- In the event that you are unable to manage your finances, a revocable trust sets up a method for you to pass control to a person you choose.

- The revocable trust is set up as what is called a grantor trust. This means that you do not have to concern yourself with any additional tax documentation. You can take your tax credits or deductions just as you always have. In this way, the trust is simple to manage.

- Often revocable trusts are set up to distribute all of your property and terminate after you die. However, you may also set up the trust to continue to hold money for your children under a spendthrift provision, which protects your child’s inheritance against his or her creditors.

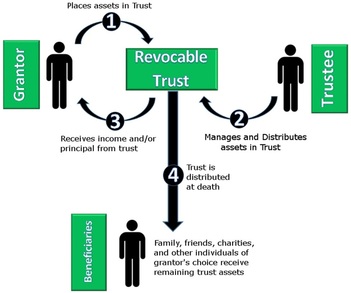

What is a Trust?--A trust is a written agreement that names one person, the trustee, to be responsible for managing property for the benefit of others (the beneficiaries.) In general, a revocable living trust allows you to manage your money as trustee, and receive income and principal (those assets that you placed in the trust) for life. The remainder then passes to your beneficiaries.

What is a “revocable” Trust?--A revocable trust allows the creator (the grantor) to change or end the trust at any time and for any reason.

What is a “living” Trust?--A living trust is a trust created and funded during your lifetime. You may also create a trust in your will, to be funded after your death. This is known as a testamentary trust.

- What differs between “living” and “testamentary” trusts?--The main difference between a living trust and a testamentary trust is whether the assets go through probate. The primary purpose of a living trust is probate avoidance.

Probate:

What is probate?--Probate is a court-supervised process transferring ownership of a deceased individual’s (decedent’s) assets.

What are the advantages of probate?--Probate has two main advantages:

- Probate ends creditors’ claims. If a creditor fails to make a claim against the property within the allotted three to four months after receiving notice, they waive the right to any claim against the property. (This result may also be achieved by providing notice with the trust, but you will not be forced to do so.)

- Probate creates proof of the value of property at date of death. Inherited property has a tax basis equal to the value of the property the day the decedent died. Therefore, when inherited property is sold, taxes are only due on the sales price above the value that the property had on the date of death. Probate serves as a means to prove the value of the property as of the date of death for this tax purpose.

- Cost— Probate costs include a filing fee of 0.2% of the value of the total probate property, attorney fees (which can run in the $4000 range,) and personal representative fees (if your personal representative chooses to ask for a fee.)

- Time—Distributions may only be made from the probate estate after the three to four month waiting period for creditor claims has elapsed. The family may only receive money before this time by court order.

Revocable Trust Disadvantages:

Are there any disadvantages to a revocable trust?—A revocable trust has several disadvantages:

- If you ever appoint someone other than yourself or your spouse as trustee of the trust, the trust will be required to file a yearly informational report to the IRS.

- A revocable trust needs maintenance. If you receive assets at a future date, you will have to be sure to put the assets in the revocable trust, otherwise you will not avoid probate. This can be accomplished on your own, or with simple guidance from an attorney. It may include assuring that any deeds for property are properly assigned to the trust and not to yourselves.

Should I have a revocable trust?--To determine whether you should have a revocable trust, you should consider both the advantages and disadvantages as they apply to your own scenario. For assistance with determining whether a revocable living trust is right for you, contact Attorney Derrick Heller-Neal via phone at (262)902-0595 or by email hellerneal@hellerneal.com to schedule a consultation.

RSS Feed

RSS Feed